Have Unpaid Taxes? You Could Lose Your Passport

From cntraveler.com

Here’s some extra incentive to get that check to Uncle Sam on time.

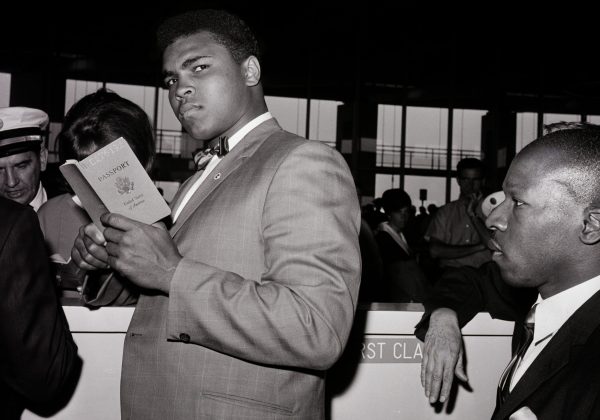

A Dutch woman was recently denied a Swiss passport because locals deemed her “too annoying.” In the U.S., other, more common grounds for passport dismissal routinely make the news: someone wears glasses in their passport photo, say, or is a convicted felon on parole. Now, another reason your passport can be denied is coming to light: unpaid taxes.

The idea of using travel to enforce tax collection isn’t anything new: It was proposed in the U.S. government as early as 2012, and rejected. But in late 2015, Congress came around to the idea, and President Obama signed it into law. Forbes reports that the IRS has just released new details about what the tax code stipulation, titled “Revocation or Denial of Passport in Case of Certain Unpaid Taxes” entails. According to the rule, if you have seriously delinquent tax debt, the IRS is authorized to notify the State Department, which can revoke an existing passport, or “generally” not issue or renew a passport after receiving such a flag. The IRS is also required to notify you in writing that they have contacted the State Department, which gives you an opportunity to straighten out your financials and any immediate travel plans (more on that later). But just what qualifies as “seriously delinquent tax debt”? Federal tax debt totaling more than $50,000, including penalties and interest.

Some (sort of) good news: Before denying you a passport altogether, however, the State Department will hold your application for 90 days to allow you to “resolve any erroneous certification issues, make full payment of the tax debt, or enter into a satisfactory payment alternative with the IRS.” (A revoked passport is a different story, with the IRS noting that “There is no grace period for resolving your debt before the State Department revokes an existing passport,” though anyone who receives such an alert and has immediate travel plans can call a special number listed on their written notification.) According to the fine print, once you’ve resolved the tax issue with the IRS, it will reverse the certification within 30 days of resolution of the issue. Even better news, if you think you may be in trouble and need some more time to get your finances in order, the IRS says it will begin such certifications in early 2017 (any day now), and that the website will be updated to reflect the new policy when they do so.